House Price Index: October 2024: Trends in the UK Housing Market

As we head into the final quarter of 2024, the UK housing market is continuing to navigate a challenging landscape, shaped by changing economic conditions, interest rates, and regional disparities. The House Price Index (HPI) for October 2024 reveals significant insights into the state of the UK housing price trends, and how potential buyers and sellers are responding to the ongoing shifts in the market.

Current Trends in the UK Housing Market

October’s House Price Index has shown a moderate slowdown in the growth of house prices across the UK. While prices are still higher than pre-pandemic levels, there is evidence of cooling in several areas as economic pressures and interest rate hikes take their toll. The average UK housing price has increased by just 2.3% in the year to October 2024, a notable reduction from the more rapid price hikes witnessed in 2021 and 2022.

This slowdown is largely attributed to the Bank of England’s efforts to tame inflation through interest rate increases. As borrowing costs rise, fewer people are entering the property market, especially first-time buyers who are struggling to meet the affordability of mortgages. Despite this, there are still areas in the country where house prices continue to rise, driven by local demand and housing supply constraints.

Regional Variations in the UK Housing Price

One of the defining features of the UK housing market in 2024 is the regional variation in house prices. While some parts of the country are experiencing price reductions, others are seeing resilience, and in certain cases, even growth.

London and the South East: The capital and its surrounding areas have experienced a slower pace of price growth, especially in the high-end market. However, London remains a key area of interest for international buyers, which helps maintain a degree of stability in housing prices. The average house price in London has risen by 1.8% year-on-year as of October 2024.

Northern Regions: In contrast, northern regions such as the North West, Yorkshire and the Humber, and the North East have shown more robust growth in house prices, with some areas seeing increases of up to 5% over the past year. These regions are benefiting from growing interest in more affordable housing outside of the major metropolitan areas, as workers embrace hybrid working arrangements.

What Does This Mean for the UK Housing Market?

The October 2024 House Price Index reflects a market that is increasingly characterized by caution, with affordability continuing to be a key issue. The UK housing price growth is expected to remain subdued through the remainder of 2024, with regional differences playing a more prominent role than ever before.

For homeowners, particularly those looking to sell, it’s important to be mindful of local market conditions. While some regions may still see price increases, others may be more difficult to navigate, especially with the ongoing economic uncertainty. Sellers in more competitive markets might need to adjust their expectations to reflect the current market environment.

2024: A Remarkable Year for Housing Sales

2024 is shaping up to be a standout year for housing sales, as fierce competition among lenders has driven average mortgage rates to their lowest levels in two years. Combined with rising incomes, this has fuelled the highest level of new sales agreed since the post-pandemic boom in 2020.

House prices are rising at a slower pace, increasing by just 1% over the 12 months to September 2024, compared to a decline of -0.9% the previous year. Price inflation remains subdued due to the wide range of properties on the market, while affordability pressures continue to limit purchasing power.

Regions with more affordable housing, such as the North East (2.0%), Yorkshire and the Humber (2.0%), the North West (2.3%), Scotland (2.4%), and Northern Ireland (5.6%), are seeing above-average house price growth. Meanwhile, modest declines are being recorded in the East of England (-0.3%) and the South East (-0.1%). Overall, UK house prices are expected to end 2024 approximately 2% higher.

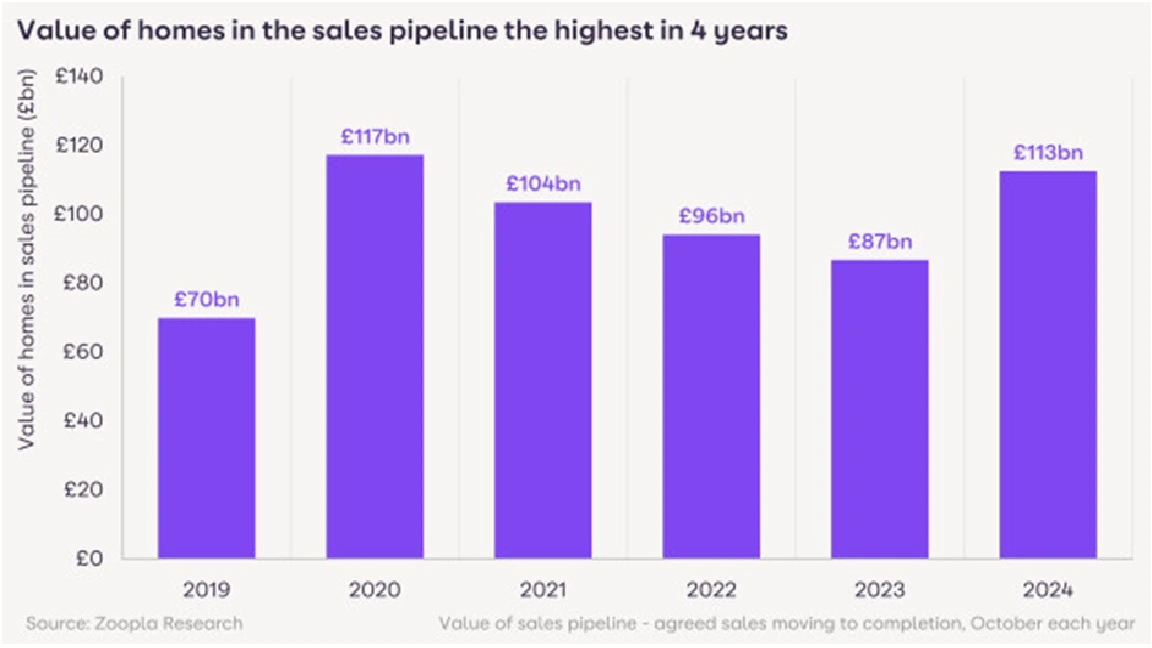

Sales Pipeline at Its Largest in Four Years, Up 30% on Last Year

The continued growth in new sales throughout the year has resulted in the largest sales pipeline seen in the past four years. We estimate that there are currently 306,000 homes with a sale agreed upon, progressing through the buying process towards completion. This is an increase of 62,000 homes (26%) compared to the same time last year.

The total sales value of homes in the pipeline stands at £113bn, which is 30% higher than this time last year. This increase follows a period in 2023 when a surge in mortgage rates dampened buyer demand, leading to a reduction in the number of sales agreed during the second half of the year.

The momentum in new sales is expected to continue into December, with many recent sales likely to be completed in the first half of 2025.

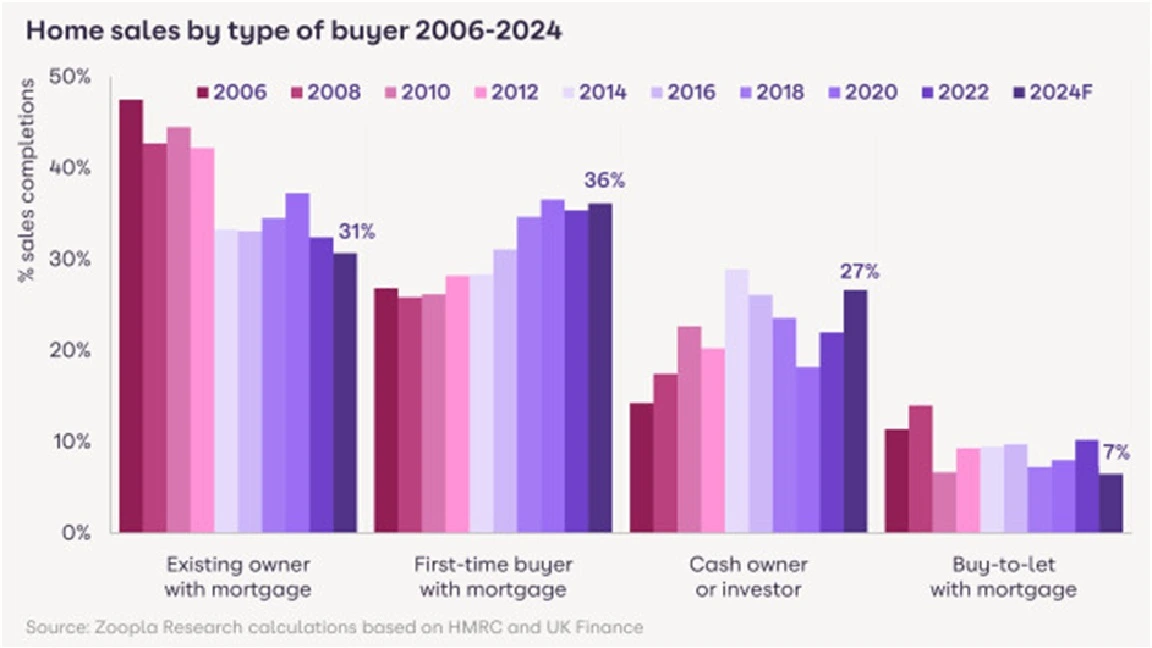

First-Time Buyers: The Largest Buyer Group in 2024

First-time buyers (FTBs) are set to become the largest buyer group in 2024, accounting for 36% of all sales. This is followed by existing homeowners purchasing with a mortgage, who make up 31% of the market.

Cash buyers are expected to account for 27% of sales, including homeowners who have paid off their mortgages and some mortgage-free investors. Landlords purchasing properties with buy-to-let mortgages are forecast to represent 7% of transactions, with their numbers affected by higher mortgage rates.

The sharp rise in rents, coupled with the decline in mortgage rates, has shifted the balance between renting and buying, encouraging more FTB purchases. On average, mortgage repayments for a typical first-time buyer home are now 17% cheaper than renting, compared to just a 2% difference a year ago when mortgage rates were higher.

First-time buyers Benefit from Landlord Sales

First-time buyer numbers are being bolstered by landlords selling properties, as these homes tend to have lower average asking prices. Of all homes listed for sale, 12% were previously rented, with a higher-than-average concentration of landlord sales occurring in London.

The average asking price of a previously rented home is £307,000, which is 16% lower than the average UK asking price of £365,000.

This is a positive development for the sales market and likely explains the improved market performance in London. However, it is less favorable for the rental market, which is already experiencing a chronic undersupply of homes. Landlords selling up contributes to this scarcity, driving rents higher and disproportionately affecting lower-income renters.

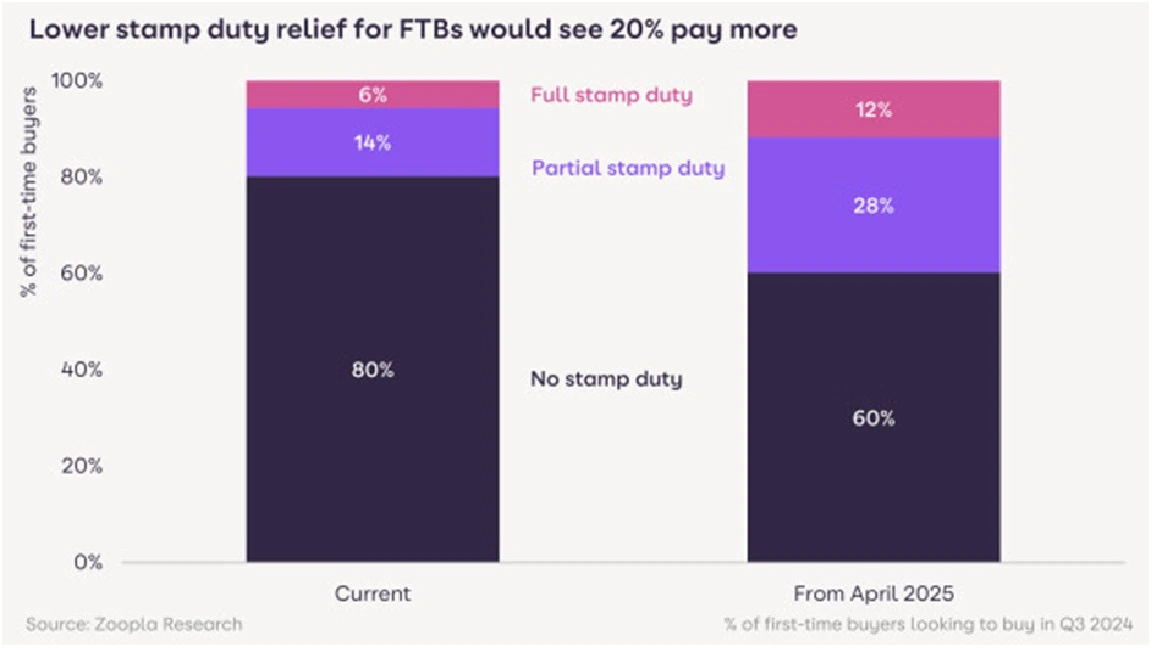

Government Budget 2024: Stamp Duty Tax

First-time buyers (FTBs) currently benefit from relief on stamp duty land tax in England and Northern Ireland, paying no stamp duty on properties valued up to £425,000, and only partial stamp duty on homes priced up to £625,000. At present, 80% of FTBs pay no stamp duty, while 14% pay a reduced amount.

However, these thresholds are set to revert to their previous, lower levels from April 2025. Unless action is taken in the upcoming Budget, 20% of FTBs will once again be required to pay stamp duty.

The impact of these changes will be most significant in southern England, where an average FTB in London would face a stamp duty bill of £5,600, or £1,390 in the South East, compared to £0 today.

In parts of London where property values exceed £600,000, FTBs could face an additional £15,000 in stamp duty costs. With these higher expenses, FTBs will likely aim to negotiate lower purchase prices, helping to keep future price rises in check.

Looking Ahead: The Future of UK Housing Prices

The outlook for the UK housing market in 2025 will largely depend on the wider economic climate, particularly how the Bank of England handles inflation and interest rates in the coming months. If inflation begins to decrease significantly, there could be room for more favorable borrowing conditions, which may reignite house price growth. However, if inflation remains persistent, we may continue to see more price stabilization in the short to medium term.

In conclusion, October 2024’s House Price Index highlights a more restrained UK housing market compared to the frenzied years of the pandemic. While UK housing prices remain elevated in many parts of the country, the market is increasingly influenced by economic factors, regional disparities, and buyer affordability. Those involved in buying or selling in this environment should be prepared for an ongoing period of adjustment.

The House Price Index for October 2024 provides a comprehensive snapshot of the current UK housing market, revealing a mixture of stability and caution. As UK housing prices stabilize following a period of high growth, homeowners and prospective buyers must navigate a market shaped by economic factors, regional differences, and the ongoing effects of interest rate changes. While challenges remain, the housing market in the UK remains resilient, and with careful planning, opportunities for both buyers and sellers will continue to arise.